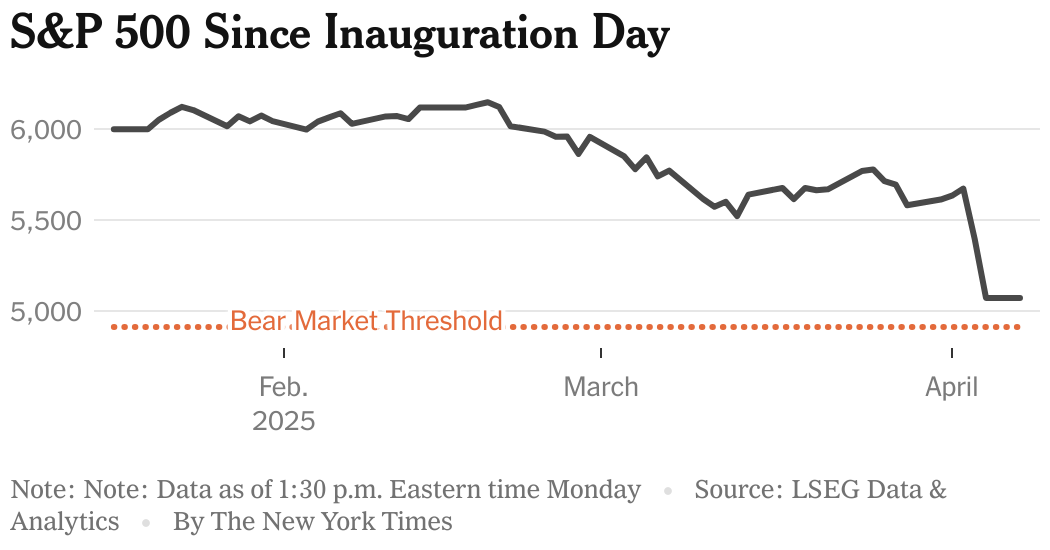

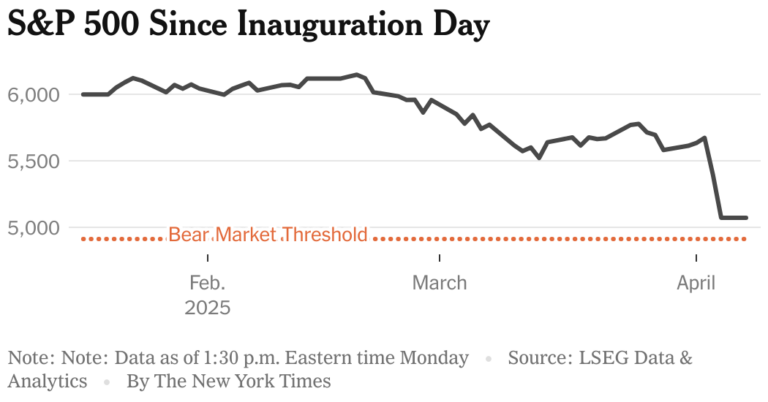

The global rates of President Trump sent share markets all over the world in a tail El’s & P 500 on Monday has briefly entered the territory of the Orsi market for the first time since 2022.

Mr. Trump seemed crazy from the decline. On Monday he reported that he had no intention of withdrawing on rates, insisting on the fact that they would lead to “billions of dollars” of revenue and that other countries had “abused” the United States with their commercial policies.

Here’s what to know about a bears market.

What is a bears market?

A bears market is a Wall Street term for a prolonged market recession, when an equity index closes 20 percent from its latest peak.

The 20 percent threshold reports the pessimism of investors on the future of the economy.

Are we in a bears market now?

The S&P 500, the US Equity index of Benchmark, was open on Monday. The index was already falling by 17.4 percent from his latest maximum, on February 19, and if he closes the trading on Monday with a loss of at least 3.1 percent, this overturns it in a bears market.

Morgan Stanley’s analysts have warned that an even more steep drop is possible. Goldman Sachs cut his forecasts for economic growth on Monday, citing a growing risk of a recession in the United States next year.

The Nasdaq composite index, as well as the Russell 2000 index of smaller companies that are more vulnerable to economic perspectives, are already in a bears market.

This seems threatening. What should I do with my money?

A decline in the market can offer opportunities for investors with long horizons. Investing in diversified and low indexed funds has been a successful strategy over the years, through markets and bears.

But given the in -depth concern that the commercial agenda of Mr. Trump could trigger a serious economic recession, volatility and uncertainty are high. People with shorter investment times, as well as those who approach retirement, often move more activities in bonds, which have historically shown a greater resilience during recessions.

When was the last bears market and how long does one last?

The US stock market has always recovered from the drop, usually within a couple of years. At the beginning of 2020, the outbreak of the Coronavirus unleashed global arrests, causing a short and acute bears market. The Federal Reserve intervened and the markets resumed losses in six months. At the end of 2021, the fears of increasing the inflation that lead to clearly higher interest rates brought the S&P to a bears market at the beginning of 2022, which lasted for most of the year.

The S&P entered a bear market 15 times since 1929. The bear markets lasted on average 18.9 months, according to Howard Silverblatt, senior index analyst for the S&P Jones Indices.

How do the bear markets influence the economy?

The bear markets are sometimes precursors of the recessions, but not always.

The recessions, defined by the National Bureau of Economic Research as “a significant decline in the economic activity that spreads throughout the economy and lasts more than a few months”, are much more dangerous for the economy. The recessions often lead to losses of jobs while economies contract, as in the summer of 2020, when unemployment levels rose to their worst levels from the great depression.

Where do these names originate – Tori and Orsi -?

The exact origins of the sentence are not clear. But they entered the mainstream vernacular in London in the 18th century. A theory trace “bear” to the proverb “to sell the skin of the bear before capturing the bear”, according to Merriam Webster. The poet Alexander Pope and other writers have contributed to spreading the use of Bull or Bear words to describe the stock market when writing on the frenetic manifestation of the actions of the Southern Sea Company and his notorious Purge in a financial scandal indicated as the bubble of the South Sea.

What will happen later?

Mr. Trump repeated his requests for Federal Reserve on Monday to reduce interest rates. But the Fed does not seem quickly to intervene.

Jerome H. Powell, the president of the Fed, said on Friday that the central bank needed to evaluate the economic effects of the rates before acting and warned that cutting the cutting rates could inflate inflation.

A new wave of Trump rates that will enter into force this week could lead to even more turbulence in the markets. To Sunday’s question from journalists on the tumult of the market and the fears of a recession, Trump said that “sometimes you have to take medicines to repair something”.